2025 Nanoinjection-Based Gene Editing Technologies Market Report: In-Depth Analysis of Growth Drivers, Innovations, and Global Impact. Explore Key Trends, Competitive Dynamics, and Strategic Opportunities Shaping the Next 5 Years.

- Executive Summary & Market Overview

- Key Technology Trends in Nanoinjection-Based Gene Editing

- Competitive Landscape and Leading Players

- Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

- Regional Market Analysis & Emerging Hotspots

- Challenges, Risks, and Regulatory Considerations

- Opportunities and Strategic Recommendations

- Future Outlook: Innovations and Market Evolution

- Sources & References

Executive Summary & Market Overview

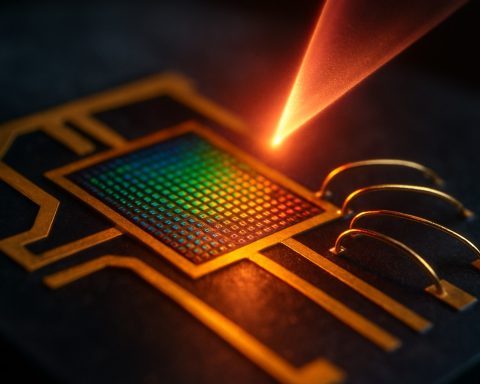

Nanoinjection-based gene editing technologies represent a cutting-edge approach within the broader field of genome engineering, leveraging nanoscale devices to deliver genetic material directly into cells with high precision and minimal cytotoxicity. Unlike traditional methods such as viral vectors or bulk electroporation, nanoinjection utilizes nanoneedles or nanopipettes to physically insert nucleic acids, CRISPR-Cas complexes, or other gene-editing tools into target cells. This method offers significant advantages in terms of delivery efficiency, cell viability, and the ability to target hard-to-transfect cell types, including primary cells and stem cells.

As of 2025, the global market for nanoinjection-based gene editing technologies is experiencing robust growth, driven by increasing demand for precise gene therapies, advancements in nanofabrication, and the expanding application of gene editing in both research and clinical settings. According to Grand View Research, the overall gene editing market is projected to reach USD 25.5 billion by 2030, with nanoinjection technologies expected to capture a growing share due to their unique capabilities. The adoption of nanoinjection is particularly notable in ex vivo cell therapy manufacturing, where maintaining cell integrity is critical for therapeutic efficacy.

Key industry players, including Nanoneedle Technologies and academic spin-offs such as Stanford University’s nanoinjection research groups, are at the forefront of commercializing these platforms. Strategic collaborations between biotech firms and research institutions are accelerating the translation of nanoinjection from laboratory innovation to clinical application. Furthermore, regulatory agencies such as the U.S. Food and Drug Administration (FDA) are increasingly engaging with developers to establish safety and efficacy standards for nanoinjection-based products.

Regionally, North America and Europe dominate the market, supported by strong R&D infrastructure, favorable funding environments, and a high concentration of gene therapy clinical trials. However, Asia-Pacific is emerging as a significant growth area, with countries like China and Japan investing heavily in nanotechnology and regenerative medicine.

In summary, nanoinjection-based gene editing technologies are poised to transform the landscape of genetic medicine by enabling safer, more efficient, and highly targeted gene modifications. The market outlook for 2025 is characterized by rapid innovation, increasing investment, and expanding clinical adoption, positioning nanoinjection as a pivotal technology in the next generation of gene therapies.

Key Technology Trends in Nanoinjection-Based Gene Editing

Nanoinjection-based gene editing technologies are rapidly evolving, driven by the need for precise, efficient, and minimally invasive delivery of genetic material into living cells. Unlike traditional methods such as viral vectors or bulk electroporation, nanoinjection leverages nanoscale devices—often fabricated from silicon or other biocompatible materials—to physically insert nucleic acids, proteins, or CRISPR-Cas components directly into target cells. This approach offers significant advantages in terms of cell viability, targeting specificity, and the ability to manipulate hard-to-transfect cell types, such as primary neurons or stem cells.

Key technology trends shaping the nanoinjection-based gene editing landscape in 2025 include:

- Integration with CRISPR Systems: The convergence of nanoinjection platforms with CRISPR-Cas9 and next-generation gene editing tools is enabling highly targeted genome modifications. Companies and research institutions are developing nanoinjectors capable of delivering ribonucleoprotein complexes (RNPs) with high efficiency, reducing off-target effects and enhancing editing precision (Nature Biotechnology).

- Automated and High-Throughput Platforms: Recent advances focus on automating the nanoinjection process, allowing for parallel processing of thousands of cells. This is particularly relevant for applications in cell therapy manufacturing and functional genomics, where scalability and reproducibility are critical (Thermo Fisher Scientific).

- Material Innovation: The development of new nanoinjector materials—such as flexible polymers, carbon nanotubes, and hybrid composites—improves biocompatibility and reduces cellular stress. These innovations are expanding the range of cell types amenable to nanoinjection and minimizing cytotoxicity (Nano Today).

- Real-Time Monitoring and Feedback: Integration of nanosensors and imaging modalities with nanoinjection devices allows for real-time monitoring of delivery events and cellular responses. This feedback loop enhances process control and supports the development of adaptive gene editing protocols (Trends in Biotechnology).

These trends are collectively driving the adoption of nanoinjection-based gene editing in both research and clinical settings, with a growing number of startups and established players investing in next-generation delivery platforms. As the technology matures, it is expected to play a pivotal role in the advancement of personalized medicine, regenerative therapies, and functional genomics research.

Competitive Landscape and Leading Players

The competitive landscape for nanoinjection-based gene editing technologies in 2025 is characterized by a dynamic mix of established biotechnology firms, innovative startups, and academic spin-offs, all vying for leadership in precision gene delivery. Nanoinjection, which leverages nanoscale devices to physically deliver genetic material into cells, is gaining traction as a promising alternative to traditional viral and chemical transfection methods due to its high efficiency and reduced cytotoxicity.

Key players in this space include Thermo Fisher Scientific, which has expanded its gene editing portfolio through strategic acquisitions and partnerships, and Lonza Group, known for its advanced cell and gene therapy manufacturing platforms. Both companies are investing in nanoinjection R&D to enhance delivery precision and scalability for clinical applications.

Emerging companies such as NanoCellect Biomedical and Nanolive are making significant strides by developing proprietary nanoinjection devices tailored for high-throughput gene editing in research and therapeutic settings. These firms focus on miniaturized, automated systems that enable rapid, reproducible delivery of CRISPR-Cas9 and other gene editing tools into a wide range of cell types, including hard-to-transfect primary cells.

Academic spin-offs, such as those originating from collaborations with institutions like Stanford University and MIT, are also contributing to the competitive landscape by commercializing novel nanoinjection platforms. These entities often benefit from early-stage funding and partnerships with larger biotech firms to accelerate product development and regulatory approval.

The market is further shaped by ongoing patent activity and licensing agreements, as companies seek to protect proprietary nanoinjection technologies and expand their application scope. According to a 2024 report by Grand View Research, the global gene editing market is expected to grow at a CAGR of over 15% through 2030, with nanoinjection-based approaches capturing a growing share due to their potential for safer and more targeted gene therapies.

- Thermo Fisher Scientific and Lonza Group lead in platform integration and clinical translation.

- NanoCellect Biomedical and Nanolive drive innovation in device miniaturization and automation.

- Academic spin-offs accelerate disruptive technology transfer and early adoption.

Overall, the competitive landscape in 2025 is marked by rapid innovation, strategic collaborations, and a focus on clinical-grade nanoinjection solutions, positioning the sector for significant growth and impact in gene therapy and regenerative medicine.

Market Size, Growth Forecasts & CAGR Analysis (2025–2030)

The global market for nanoinjection-based gene editing technologies is poised for robust expansion between 2025 and 2030, driven by accelerating adoption in both research and therapeutic applications. Nanoinjection, which enables precise delivery of genetic material into cells with minimal cytotoxicity, is increasingly favored over traditional transfection and microinjection methods, particularly in the context of CRISPR and other gene editing platforms.

According to projections by Grand View Research, the broader gene editing market is expected to reach over USD 25 billion by 2030, with nanoinjection-based approaches representing a rapidly growing segment due to their enhanced efficiency and scalability. While specific figures for nanoinjection are less frequently isolated, industry analyses suggest that this segment will experience a compound annual growth rate (CAGR) of approximately 18–22% from 2025 to 2030, outpacing the overall gene editing market’s CAGR of 15–17% during the same period.

Key drivers of this growth include:

- Rising demand for high-precision gene editing in cell and gene therapy pipelines, particularly for ex vivo modification of stem cells and immune cells.

- Increased investment in nanotechnology-enabled delivery systems by leading biotechnology firms such as Thermo Fisher Scientific and Lonza Group, which are actively developing proprietary nanoinjection platforms.

- Expanding applications in agricultural biotechnology, where nanoinjection is used to create genetically modified crops with improved traits.

Regionally, North America is anticipated to maintain the largest market share through 2030, supported by strong R&D infrastructure and favorable regulatory pathways. However, Asia-Pacific is projected to register the fastest CAGR, fueled by increasing government funding and the emergence of local players investing in advanced gene editing technologies (MarketsandMarkets).

In summary, the nanoinjection-based gene editing technologies market is set for significant growth from 2025 to 2030, with a projected CAGR of 18–22%. This expansion will be underpinned by technological advancements, broadening application scope, and strategic investments from both established and emerging industry participants.

Regional Market Analysis & Emerging Hotspots

The regional market landscape for nanoinjection-based gene editing technologies in 2025 is characterized by significant disparities in adoption, investment, and regulatory frameworks. North America, particularly the United States, remains the dominant market, driven by robust R&D funding, a high concentration of biotechnology firms, and supportive regulatory pathways. The presence of leading academic institutions and partnerships between industry and research organizations have accelerated the commercialization of nanoinjection platforms for both therapeutic and agricultural applications. According to Grand View Research, North America accounted for over 40% of the global gene editing market share in 2024, with nanoinjection technologies gaining traction due to their precision and reduced off-target effects.

Europe follows closely, with countries such as Germany, the United Kingdom, and France investing heavily in next-generation gene editing tools. The European Union’s Horizon Europe program has earmarked substantial funding for nanotechnology and genome engineering, fostering a competitive environment for startups and established players alike. However, the region’s stringent regulatory environment, particularly concerning genetically modified organisms (GMOs), poses challenges for rapid market expansion. Nevertheless, the European Medicines Agency’s evolving stance on advanced therapies is expected to facilitate greater clinical adoption of nanoinjection-based approaches in the coming years (European Medicines Agency).

Asia-Pacific is emerging as a hotspot, with China, Japan, and South Korea making strategic investments in nanoinjection research and infrastructure. China’s government-backed initiatives and the rapid scaling of biotech startups have positioned the country as a key innovator in the field. The region’s relatively flexible regulatory environment and large patient populations are attracting multinational collaborations and clinical trials. According to Fortune Business Insights, Asia-Pacific is projected to witness the fastest CAGR in the gene editing sector through 2027, with nanoinjection technologies playing a pivotal role in agricultural biotechnology and regenerative medicine.

- North America: Market leadership, strong R&D, favorable regulatory trends.

- Europe: High investment, regulatory hurdles, growing clinical adoption.

- Asia-Pacific: Fastest growth, government support, expanding clinical and agricultural applications.

Emerging hotspots also include Israel and Singapore, where government incentives and a focus on translational research are fostering innovation in nanoinjection-based gene editing. These regions are expected to contribute to the global competitive landscape, particularly in niche therapeutic and crop science applications.

Challenges, Risks, and Regulatory Considerations

Nanoinjection-based gene editing technologies, which utilize nanoscale devices to deliver genetic material directly into cells, present a promising alternative to traditional viral and chemical transfection methods. However, as these technologies move toward broader clinical and commercial adoption in 2025, several challenges, risks, and regulatory considerations must be addressed.

One of the primary technical challenges is achieving consistent delivery efficiency and cell viability across diverse cell types. While nanoinjection can reduce cytotoxicity compared to some chemical methods, the mechanical penetration of cell membranes still poses risks of cell damage and unintended immune responses. Additionally, scaling up nanoinjection platforms for high-throughput applications remains a significant hurdle, as current systems often require precise alignment and control that are difficult to automate at industrial scales (Nature Biotechnology).

From a risk perspective, off-target effects and genomic instability are critical concerns. Although nanoinjection allows for precise delivery, the gene editing tools themselves (such as CRISPR-Cas9) can still introduce unintended mutations. The long-term effects of these edits, especially in therapeutic contexts, are not yet fully understood. Furthermore, the use of nanomaterials introduces potential toxicity and biocompatibility issues, as the fate of nanoparticles within the body and their interactions with biological systems require thorough investigation (U.S. Food and Drug Administration).

- Regulatory Uncertainty: Regulatory frameworks for nanoinjection-based gene editing are still evolving. Agencies such as the U.S. Food and Drug Administration and the European Medicines Agency are developing guidelines for both nanotechnology and gene editing, but harmonized standards are lacking. This creates uncertainty for developers regarding clinical trial requirements, safety assessments, and post-market surveillance.

- Ethical and Social Considerations: The potential for germline editing and heritable genetic changes raises ethical questions, particularly in jurisdictions with strict regulations on human genetic modification. Public perception and acceptance of nanoinjection-based therapies may also influence regulatory decisions and market adoption (Nature).

In summary, while nanoinjection-based gene editing technologies offer significant advantages, their path to widespread use in 2025 is shaped by technical, safety, and regulatory challenges that require coordinated efforts from industry, regulators, and the scientific community.

Opportunities and Strategic Recommendations

The nanoinjection-based gene editing technologies market in 2025 presents a dynamic landscape of opportunities, driven by the convergence of precision medicine, advanced nanotechnology, and increasing demand for efficient gene delivery systems. Nanoinjection, which utilizes nanoscale needles or probes to deliver genetic material directly into cells, offers significant advantages over traditional viral and chemical transfection methods, including reduced cytotoxicity, higher delivery efficiency, and the ability to target hard-to-transfect cell types.

Key opportunities in this sector stem from the growing adoption of gene therapies for rare and inherited diseases, as well as the expanding pipeline of cell and gene therapy candidates in clinical trials. The U.S. Food and Drug Administration (FDA) and European Medicines Agency (EMA) have accelerated approvals for gene therapies, creating a favorable regulatory environment for innovative delivery technologies such as nanoinjection. Furthermore, the increasing investment in personalized medicine and regenerative therapies is expected to fuel demand for precise and minimally invasive gene editing tools.

- Strategic Partnerships: Companies should pursue collaborations with leading academic research centers and biotechnology firms to accelerate the development and validation of nanoinjection platforms. Such partnerships can facilitate access to novel gene editing tools (e.g., CRISPR, TALENs) and expand the range of therapeutic applications. For example, alliances with organizations like the Broad Institute or CRISPR Therapeutics can provide access to cutting-edge gene editing expertise.

- Platform Diversification: Expanding the application of nanoinjection beyond human therapeutics to include agricultural biotechnology, animal health, and synthetic biology can open new revenue streams. The agricultural sector, in particular, is seeking precise gene editing solutions for crop improvement and disease resistance, as highlighted by Syngenta and Bayer.

- Regulatory Engagement: Proactive engagement with regulatory agencies is essential to streamline approval pathways and establish industry standards for nanoinjection devices. Early dialogue with the FDA and EMA can help address safety and efficacy concerns, expediting market entry.

- Intellectual Property (IP) Strategy: Securing robust IP protection for nanoinjection devices and related gene editing protocols will be critical for maintaining competitive advantage. Companies should monitor patent landscapes and pursue strategic filings, as evidenced by recent activity from Thermo Fisher Scientific and Lonza.

In summary, the nanoinjection-based gene editing market in 2025 is poised for growth, with strategic opportunities centered on partnerships, platform expansion, regulatory alignment, and IP management. Companies that capitalize on these areas are likely to secure leadership positions in this rapidly evolving field.

Future Outlook: Innovations and Market Evolution

The future outlook for nanoinjection-based gene editing technologies in 2025 is marked by rapid innovation and a dynamic market evolution, driven by the convergence of nanotechnology, synthetic biology, and precision medicine. Nanoinjection, which utilizes nanoscale devices to deliver genetic material directly into cells with high precision, is poised to address key limitations of traditional gene editing delivery methods, such as viral vectors and bulk electroporation. This technology is expected to enable safer, more efficient, and less immunogenic gene editing, particularly for ex vivo and in vivo therapeutic applications.

In 2025, several trends are shaping the innovation landscape. First, the integration of advanced materials—such as carbon nanotubes, silicon nanowires, and biodegradable polymers—into nanoinjection devices is enhancing biocompatibility and targeting specificity. Companies and research institutions are developing next-generation nanoinjectors capable of multiplexed delivery, allowing simultaneous editing of multiple genes or cell types, which is critical for complex diseases like cancer and genetic disorders (Nature Biotechnology).

Second, automation and miniaturization are accelerating the scalability of nanoinjection platforms. Startups and established players are introducing microfluidic-based nanoinjection systems that can process thousands of cells per second, making the technology more suitable for clinical and industrial-scale applications (Thermo Fisher Scientific). This is expected to reduce costs and improve reproducibility, addressing key barriers to commercialization.

From a market perspective, the global gene editing market is projected to surpass $15 billion by 2025, with nanoinjection technologies capturing a growing share due to their unique advantages in precision and safety (Grand View Research). Strategic partnerships between biotech firms, academic institutions, and device manufacturers are fostering a robust innovation ecosystem. Regulatory agencies are also adapting frameworks to accommodate the novel risk profiles and therapeutic potential of nanoinjection-based approaches (U.S. Food and Drug Administration).

- Emerging applications include cell and gene therapies, regenerative medicine, and functional genomics research.

- Key challenges remain in standardizing protocols, ensuring long-term safety, and navigating complex intellectual property landscapes.

- Ongoing clinical trials and preclinical studies in 2025 are expected to provide critical data on efficacy and safety, influencing future adoption rates.

Overall, nanoinjection-based gene editing technologies are set to play a transformative role in the next wave of genomic medicine, with 2025 marking a pivotal year for both technological breakthroughs and market expansion.

Sources & References

- Grand View Research

- Stanford University

- Nature Biotechnology

- Thermo Fisher Scientific

- Nanolive

- MIT

- MarketsandMarkets

- European Medicines Agency

- Fortune Business Insights

- Broad Institute

- Syngenta