Graphene Photonics Manufacturing Industry Report 2025: Market Dynamics, Growth Projections, and Strategic Insights for the Next 5 Years

- Executive Summary & Market Overview

- Key Technology Trends in Graphene Photonics Manufacturing

- Competitive Landscape and Leading Players

- Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

- Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

- Future Outlook: Emerging Applications and Investment Hotspots

- Challenges, Risks, and Strategic Opportunities

- Sources & References

Executive Summary & Market Overview

Graphene photonics manufacturing refers to the industrial-scale production of photonic devices and components that leverage the unique optical and electronic properties of graphene—a single layer of carbon atoms arranged in a hexagonal lattice. Graphene’s exceptional conductivity, flexibility, and broadband optical absorption make it a transformative material for photonics, enabling advancements in modulators, detectors, waveguides, and flexible optoelectronic devices.

As of 2025, the global graphene photonics manufacturing market is experiencing robust growth, driven by escalating demand for high-speed data transmission, next-generation optical communication systems, and advanced imaging technologies. The integration of graphene into photonic circuits is accelerating due to its compatibility with existing silicon photonics platforms and its potential to overcome the speed and miniaturization limitations of traditional materials. According to IDTechEx, the broader graphene market is projected to surpass $1 billion by 2025, with photonics representing a rapidly expanding segment.

Key industry players—including Graphenea, First Graphene, and VivaGraphene—are scaling up production capacities and refining manufacturing processes such as chemical vapor deposition (CVD) and liquid-phase exfoliation to meet the stringent quality and uniformity requirements of photonic applications. Strategic partnerships between material suppliers and photonic device manufacturers are fostering innovation and accelerating commercialization cycles.

Regionally, Asia-Pacific leads in both research output and manufacturing capacity, with significant investments from China, South Korea, and Japan. The European Union’s Graphene Flagship initiative continues to drive collaborative R&D, while North America remains a hub for start-ups and university spin-offs focused on photonic integration and device prototyping.

Despite the promising outlook, challenges persist in achieving large-scale, defect-free graphene synthesis and seamless integration with existing semiconductor fabrication lines. However, ongoing advancements in process engineering and quality control are expected to reduce production costs and enhance device performance, positioning graphene photonics manufacturing as a cornerstone of future optoelectronic innovation.

Key Technology Trends in Graphene Photonics Manufacturing

Graphene photonics manufacturing is undergoing rapid transformation, driven by the unique optical and electronic properties of graphene and the increasing demand for high-performance photonic devices. In 2025, several key technology trends are shaping the landscape of this sector, with a focus on scalability, integration, and device performance.

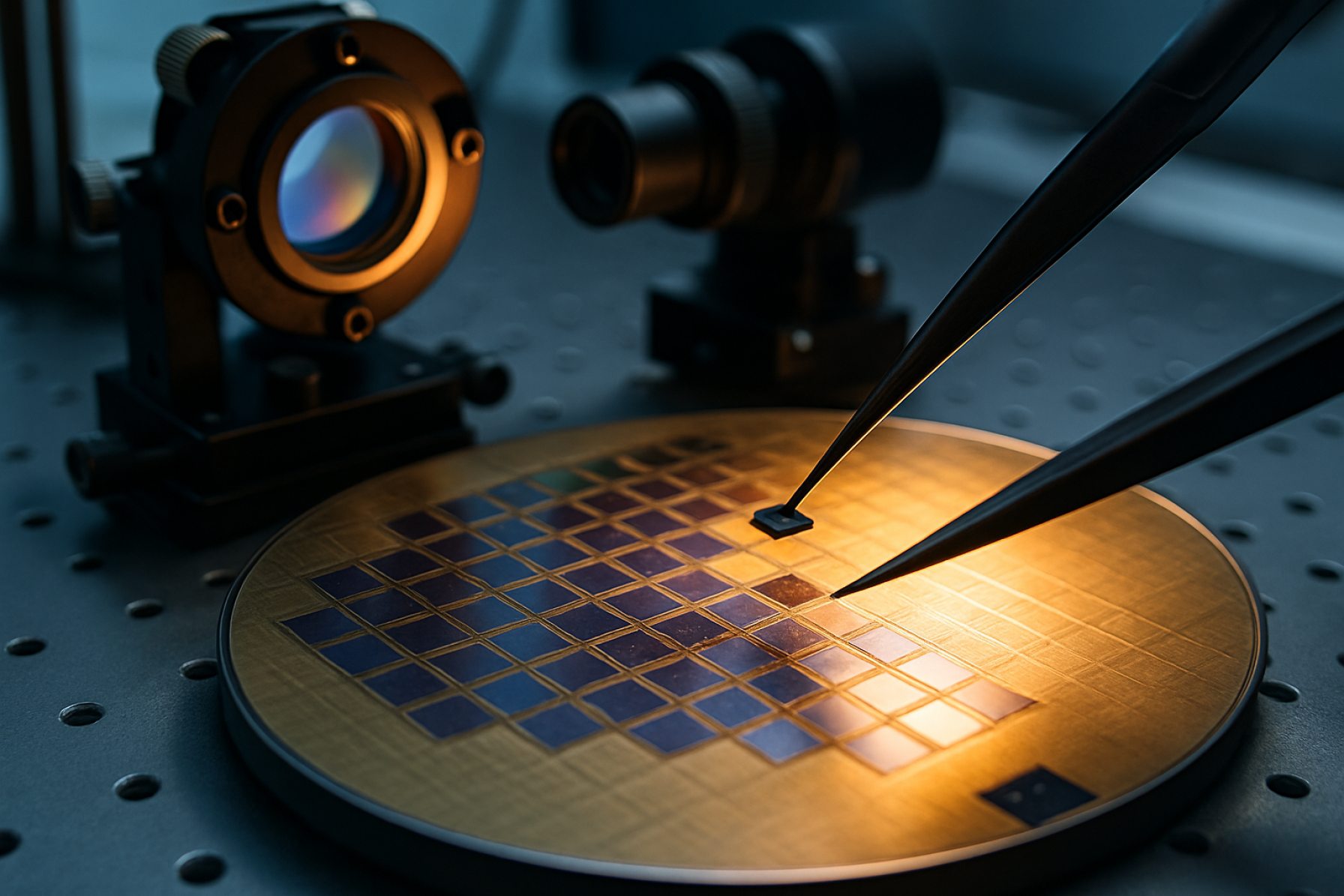

- Wafer-Scale Graphene Synthesis: The shift from small-scale exfoliation to wafer-scale chemical vapor deposition (CVD) is a pivotal trend. CVD enables the production of large-area, high-quality graphene films compatible with standard semiconductor processes, facilitating mass production of photonic components. Companies such as Graphenea and 2D Semiconductors are advancing CVD techniques to improve uniformity and reduce defects, which is critical for device reliability.

- Integration with Silicon Photonics: The integration of graphene with silicon photonics platforms is accelerating, enabling the development of ultrafast modulators, photodetectors, and switches. This hybrid approach leverages the maturity of silicon manufacturing while adding the superior optical properties of graphene. Research from imec and CSEM highlights progress in monolithic and heterogeneous integration, which is essential for scalable, cost-effective production.

- Roll-to-Roll and Printing Techniques: To address the need for flexible and large-area photonic devices, roll-to-roll and inkjet printing methods are gaining traction. These techniques allow for the deposition of graphene on flexible substrates, opening new applications in wearable photonics and flexible displays. Cambridge Nanosystems and NovaCentrix are among the innovators in this space.

- Advanced Patterning and Lithography: Precise patterning of graphene at the nanoscale is crucial for device miniaturization and performance. Advances in electron-beam lithography, nanoimprint lithography, and laser patterning are enabling the fabrication of complex photonic structures with high resolution and throughput, as reported by Oxford Instruments.

- Quality Control and Characterization: Inline metrology and real-time quality control are becoming standard in graphene photonics manufacturing. Techniques such as Raman spectroscopy and atomic force microscopy are being automated for rapid assessment of graphene quality, as detailed by HORIBA.

These technology trends are collectively driving the maturation of graphene photonics manufacturing, paving the way for commercial adoption in telecommunications, sensing, and consumer electronics by 2025 and beyond.

Competitive Landscape and Leading Players

The competitive landscape of the graphene photonics manufacturing sector in 2025 is characterized by a dynamic mix of established material science companies, innovative startups, and strategic collaborations between academia and industry. The market is driven by the increasing demand for high-speed, energy-efficient photonic devices in telecommunications, data centers, and advanced sensing applications. Key players are leveraging proprietary graphene synthesis techniques, integration capabilities, and intellectual property portfolios to differentiate themselves in a rapidly evolving ecosystem.

Among the leading players, Graphenea stands out as a major supplier of high-quality graphene materials, including CVD-grown graphene films tailored for photonic device fabrication. The company’s partnerships with photonics integrators and research institutions have enabled it to maintain a strong foothold in both the R&D and commercial segments. Versarien plc has also made significant strides, focusing on scalable production methods and the development of graphene-based optoelectronic components, targeting both European and Asian markets.

In the United States, NanoIntegris Technologies and 2D Semiconductors are recognized for their advanced material processing and customization services, catering to photonics companies seeking to integrate graphene into modulators, detectors, and waveguides. These firms emphasize quality control and reproducibility, which are critical for commercial photonics applications.

Startups such as Graphene Laboratories Inc. and Cambridge Graphene Centre (in collaboration with the University of Cambridge) are pushing the boundaries of device miniaturization and hybrid integration, often working closely with telecom and semiconductor giants to accelerate the adoption of graphene photonics in next-generation networks.

- Strategic alliances and joint ventures are increasingly common, as seen in the partnership between Graphenea and Nokia for graphene-based optical transceivers.

- Asian manufacturers, particularly in China and South Korea, are ramping up investments in graphene photonics, with companies like The Graphene Council reporting significant capacity expansions and government-backed R&D initiatives.

- Intellectual property remains a key battleground, with leading players filing patents related to graphene integration techniques, device architectures, and scalable manufacturing processes.

Overall, the competitive landscape in 2025 is marked by rapid innovation, cross-sector collaboration, and a race to achieve cost-effective, high-performance graphene photonic devices for global markets.

Market Growth Forecasts (2025–2030): CAGR, Revenue, and Volume Analysis

The graphene photonics manufacturing market is poised for robust growth between 2025 and 2030, driven by increasing demand for high-speed optical communication, advanced sensors, and next-generation optoelectronic devices. According to projections by MarketsandMarkets, the global graphene market—including photonics applications—is expected to achieve a compound annual growth rate (CAGR) of approximately 20–25% during this period. This surge is attributed to the unique properties of graphene, such as exceptional electron mobility, broadband optical absorption, and mechanical flexibility, which are being leveraged in photodetectors, modulators, and integrated photonic circuits.

Revenue forecasts for graphene photonics manufacturing specifically indicate a significant upward trajectory. By 2025, the segment is estimated to generate revenues in the range of $250–300 million, with projections suggesting this could surpass $800 million by 2030, as per data from IDTechEx. This growth is underpinned by the scaling up of production capacities, improvements in graphene synthesis methods (such as chemical vapor deposition), and the integration of graphene-based components into mainstream photonic devices.

Volume analysis reveals a parallel trend, with the annual production of graphene materials for photonics expected to increase from approximately 150 metric tons in 2025 to over 500 metric tons by 2030. This expansion is facilitated by investments from both established players and startups, as well as government-backed initiatives in regions such as Europe and Asia-Pacific. For instance, the Graphene Flagship project in the European Union continues to drive research and commercialization efforts, accelerating the adoption of graphene in photonics manufacturing.

- CAGR (2025–2030): 20–25% for graphene photonics manufacturing

- Revenue (2025): $250–300 million

- Revenue (2030): $800+ million

- Volume (2025): ~150 metric tons

- Volume (2030): 500+ metric tons

Overall, the market outlook for graphene photonics manufacturing from 2025 to 2030 is highly optimistic, with strong growth in both revenue and production volume anticipated as the technology matures and finds broader commercial adoption.

Regional Market Analysis: North America, Europe, Asia-Pacific, and Rest of World

The global graphene photonics manufacturing market is witnessing dynamic growth, with regional trends shaped by investment levels, research intensity, and end-user adoption. In 2025, North America, Europe, Asia-Pacific, and the Rest of World (RoW) regions each present distinct opportunities and challenges for graphene photonics manufacturing.

- North America: The United States leads North American activity, driven by robust R&D funding and a strong ecosystem of startups and established players. The region benefits from collaborations between academic institutions and industry, with companies like IBM and Intel investing in graphene-based photonic devices for data centers and telecommunications. The U.S. government’s continued support for advanced materials research, through agencies such as National Science Foundation, underpins innovation. However, scaling up from lab to fab remains a challenge, with manufacturing costs and process standardization as key hurdles.

- Europe: Europe is a global leader in graphene research, propelled by the Graphene Flagship initiative, which coordinates multi-country efforts to commercialize graphene technologies. The region’s photonics manufacturing sector is characterized by strong university-industry partnerships, particularly in Germany, the UK, and Scandinavia. European manufacturers are focusing on integrating graphene into photonic integrated circuits (PICs) and optical sensors, with a growing emphasis on sustainability and supply chain transparency. Regulatory harmonization across the EU is facilitating cross-border collaboration and market entry.

- Asia-Pacific: Asia-Pacific is emerging as the fastest-growing region for graphene photonics manufacturing, led by China, South Korea, and Japan. China’s government-backed investments and the presence of large electronics manufacturers such as Samsung and Huawei are accelerating commercialization. The region’s strengths include advanced manufacturing infrastructure and a focus on cost-effective mass production. According to IDTechEx, Asia-Pacific is expected to account for the largest share of new graphene photonics manufacturing capacity by 2025.

- Rest of World (RoW): While still nascent, the RoW segment—including Latin America, the Middle East, and Africa—is seeing early-stage investments and pilot projects, often in partnership with global technology leaders. These regions are primarily focused on niche applications and technology transfer, with potential for future growth as local expertise and infrastructure develop.

Overall, regional disparities in funding, infrastructure, and policy frameworks will continue to shape the competitive landscape of graphene photonics manufacturing through 2025 and beyond.

Future Outlook: Emerging Applications and Investment Hotspots

The future outlook for graphene photonics manufacturing in 2025 is marked by accelerating innovation, expanding application domains, and intensifying investment activity. As the photonics industry seeks materials that offer superior optical, electrical, and mechanical properties, graphene’s unique characteristics—such as broadband optical absorption, ultrafast carrier mobility, and mechanical flexibility—are driving its adoption in next-generation photonic devices.

Emerging applications are particularly prominent in the fields of optical communications, quantum photonics, and integrated photonic circuits. In optical communications, graphene-based modulators and photodetectors are being developed to enable faster data transmission and lower energy consumption, addressing the surging demand for bandwidth in data centers and 5G/6G networks. Companies like Nokia and Huawei are actively exploring graphene-enabled components to enhance their optical network solutions.

Quantum photonics is another emerging hotspot, with graphene’s tunable bandgap and strong light-matter interaction making it a candidate for single-photon sources and detectors—key elements for quantum communication and computing. Research institutions and startups, such as Cambridge Quantum, are investing in graphene-based quantum photonic devices, aiming to commercialize these technologies within the next few years.

Integrated photonic circuits, essential for miniaturized and energy-efficient devices, are also benefiting from graphene’s compatibility with silicon photonics platforms. This synergy is attracting investments from semiconductor giants and venture capital firms, as highlighted by funding rounds reported by IDTechEx and MarketsandMarkets. The global graphene market is projected to reach USD 2.8 billion by 2025, with photonics representing a significant growth segment.

- Investment Hotspots: Europe and Asia-Pacific are leading in graphene photonics R&D and commercialization, supported by government initiatives such as the Graphene Flagship in the EU and major funding programs in China and South Korea.

- Startup Activity: Startups like Graphenea and Graphene Laboratories are scaling up production of high-quality graphene for photonic applications, attracting strategic partnerships and venture capital.

- Manufacturing Innovations: Advances in chemical vapor deposition (CVD) and roll-to-roll manufacturing are expected to lower costs and improve scalability, making graphene photonics more commercially viable by 2025.

In summary, 2025 is poised to be a pivotal year for graphene photonics manufacturing, with rapid progress in application development and a robust investment landscape fueling the sector’s growth.

Challenges, Risks, and Strategic Opportunities

The manufacturing of graphene photonics in 2025 faces a complex landscape of challenges, risks, and strategic opportunities as the industry seeks to transition from laboratory-scale innovation to commercial-scale production. One of the primary challenges is the scalability of high-quality graphene synthesis. While chemical vapor deposition (CVD) has emerged as a leading method, maintaining uniformity, defect control, and reproducibility at wafer-scale remains a significant hurdle, directly impacting device performance and yield rates. This is compounded by the sensitivity of graphene’s optical and electronic properties to substrate interactions and environmental factors, which can introduce variability in photonic device characteristics IDTechEx.

Another risk is the integration of graphene with existing photonic platforms, such as silicon photonics. Compatibility issues, including thermal budget constraints and process contamination, can impede seamless adoption in established semiconductor fabrication lines. Furthermore, the lack of standardized processes and metrology tools for graphene characterization creates uncertainty in quality assurance and supply chain reliability MarketsandMarkets.

From a market perspective, the cost of graphene production remains a barrier to widespread adoption. Although prices have declined over the past decade, high-purity, electronics-grade graphene suitable for photonics applications still commands a premium, affecting the cost-competitiveness of end products. Intellectual property (IP) fragmentation and ongoing patent disputes also pose risks, potentially slowing down innovation and market entry for new players Grand View Research.

Despite these challenges, strategic opportunities abound. The unique optical properties of graphene—such as broadband absorption, ultrafast carrier dynamics, and tunable conductivity—position it as a key enabler for next-generation photonic devices, including modulators, detectors, and integrated optical circuits. Strategic partnerships between graphene producers, photonic foundries, and end-users are accelerating the development of standardized integration processes and application-specific solutions. Additionally, government-backed initiatives in Europe, Asia, and North America are providing funding and infrastructure to support pilot manufacturing lines and ecosystem development Graphene Flagship.

- Scalability and quality control in graphene synthesis remain critical technical challenges.

- Integration with existing photonic platforms requires overcoming compatibility and process standardization issues.

- Cost, IP risks, and supply chain uncertainties persist but are being addressed through industry collaboration and public funding.

- Strategic opportunities lie in leveraging graphene’s unique properties for disruptive photonic applications and in forming cross-sector partnerships to accelerate commercialization.

Sources & References

- IDTechEx

- First Graphene

- Graphene Flagship

- 2D Semiconductors

- imec

- CSEM

- NovaCentrix

- Oxford Instruments

- HORIBA

- Versarien plc

- NanoIntegris Technologies

- Nokia

- MarketsandMarkets

- IBM

- National Science Foundation

- Huawei

- Cambridge Quantum

- Grand View Research