- BNB is at a crossroads after a 40% drop from its all-time high of $794 in December 2024.

- The cryptocurrency faces resistance around $660, reminiscent of its peak in 2021.

- BNB relies on an ascending support trend line, providing some stability despite market volatility.

- Technical analysis shows a bearish structure with concerning RSI and MACD indicators.

- A W-X-Y corrective pattern and a symmetrical triangle suggest a potential downturn to $440.

- Investors are advised to exercise caution in the unpredictable crypto landscape.

- The future may hold a recovery to previous highs or deeper declines, leaving stakeholders anxious.

In the ever-fluctuating world of cryptocurrency, BNB stands at a critical juncture. After reaching a breathtaking all-time high of $794 in December 2024, the digital asset has experienced a staggering 40% drop amidst a shifting market trend in 2025. This rollercoaster ride has traders and investors holding their breath, trying to predict whether BNB will regain its lost glory or continue its descent.

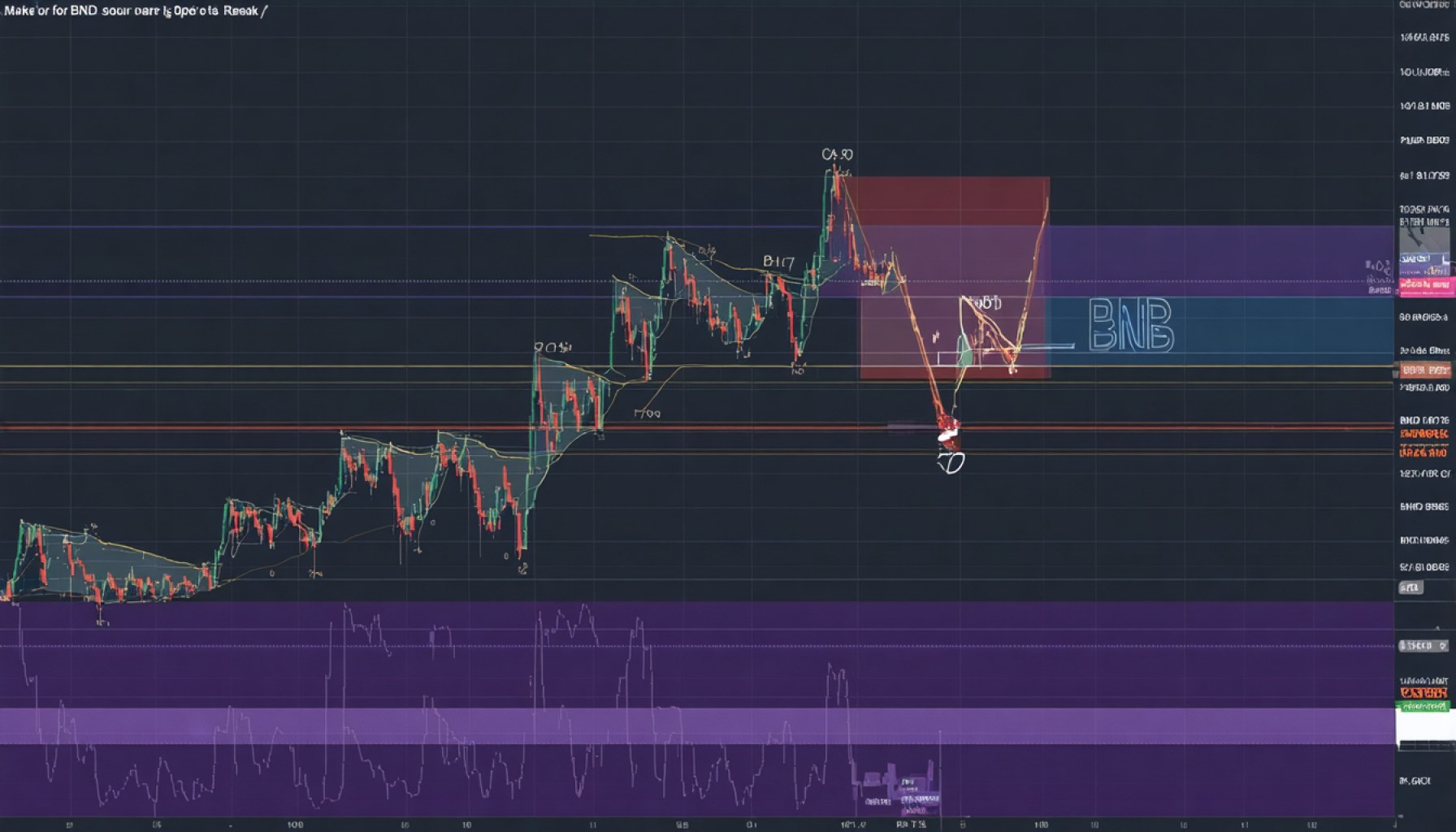

As it stands, BNB hovers just below a formidable line of resistance at $660—a number that echoes its previous peak in 2021. The narrative unfolds like a suspenseful drama, with BNB clinging to an ascending support trend line—an invisible safety net that’s caught the crypto six times over a span of 280 days. Last week’s 15% rally was a beacon of hope, yet only time will reveal if this was a mere blip or the start of a significant recovery.

The technical landscape paints a sobering picture. The patterns reveal a bearish structure, with the Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) casting shadows of doubt. A W-X-Y corrective pattern emerges ominously, suggesting that BNB might be ensnared in a symmetrical triangle, poised on the edge of a knife.

Analysts warn that this could be BNB’s last stand before a potential breakdown, possibly dragging the price down to a grim $440. It’s a game of chess between the bullish aspirations and bearish realities, leaving the crypto community in tenterhooks.

As the financial weather vane spins, one takeaway is clear: in the volatile sphere of cryptocurrency, caution is key. The stakes are high, and while the potential for gains may glint like gold, so too does the risk of losses lie in wait. Investors are urged to watch this space keenly, stay informed, and consult with financial advisors before making bold moves.

In this high-stakes narrative, BNB’s next act could either be the reclaiming of the $660 territory or a dramatic fall into deeper losses. The clock is ticking, and the crypto world watches with bated breath.

Is BNB Set for a Comeback or Further Descent? Insights You Can’t Miss

Overview of BNB’s Current Market Situation

In the dynamic landscape of cryptocurrency, Binance Coin (BNB) is navigating turbulent waters. After peaking at an impressive $794 in December 2024, BNB has tumbled down by 40% as of 2025. Currently, BNB is testing a crucial resistance level of $660, reminiscent of its 2021 highs. As market participants hold their breath, crucial questions arise: Will BNB rebound or spiral further down?

Technical Analysis: A Double-Edged Sword

– Resistance and Support Levels: BNB is clinging to an ascending support trend line, rescued six times over 280 days. This suggests a consistent buyer interest near the support, yet the looming resistance at $660 poses a challenge.

– Indicators and Patterns: The Relative Strength Index (RSI) and Moving Average Convergence/Divergence (MACD) indicators are currently pointing towards bearish sentiment. Analysts observe a W-X-Y corrective pattern and a symmetrical triangle formation, often precursors to significant price movements, whether upward or downward.

What Experts are Saying

Experts are divided, with some believing that BNB could face a downturn towards $440 if unable to break current resistance levels. Others speculate the recent 15% rally might indicate a strength build-up for a potential upward breakout.

Real-World Use Cases for BNB

BNB’s value isn’t just speculative; it holds practical utility:

1. Transaction Fee Reductions: On Binance, users benefit from discounted transaction fees when using BNB for trading.

2. Token Burns: Binance’s seasonal token burns aim to reduce the supply of BNB, potentially increasing its value over time.

3. DeFi and DApps: BNB plays a critical role in the Binance Smart Chain (BSC) ecosystem, driving transactions in decentralized applications.

Industry Trends and Market Forecasts

– Cryptocurrency Regulations: As global regulations shift, so does the potential trajectory of digital assets. Countries moving towards clearer regulatory frameworks could impact BNB’s market position.

– Adoption of Blockchain Technology: With increasing blockchain adoption, BNB’s role in transactions and smart contract platforms may grow, potentially boosting demand.

Security & Sustainability Concerns

While promising, we must consider security and sustainability. BNB’s dependence on the Binance exchange ties its fate to Binance’s credibility and security protocols.

Pros & Cons of Investing in BNB

Pros:

– Strong use case and ecosystem within Binance Smart Chain

– Ongoing BNB token burns that could increase scarcity and value

– High liquidity and trading volume

Cons:

– Heavy reliance on Binance exchange’s performance and regulatory environment

– Volatility in price influenced by crypto market’s speculative nature

Frequently Asked Questions

1. Is BNB a good investment now?

It depends on your risk tolerance and investment strategy. Consult financial advisors and research extensively before investing in volatile assets like cryptocurrencies.

2. How does BNB relate to Binance Smart Chain?

BNB is the native token of Binance Smart Chain, serving critical functions, including transaction fees and smart contract execution.

Actionable Recommendations

– Stay Informed: Follow market trends and keep updated with news from reputable sources such as CoinTelegraph or CoinDesk.

– Diversify Portfolio: Don’t put all your investments in one basket; consider diversifying to mitigate risks.

– Practice Caution: Due to the volatile nature of cryptocurrencies, invest cautiously and be prepared for potential losses.

In conclusion, while BNB’s future remains uncertain, strategic monitoring and cautious investment could position investors to leverage potential opportunities efficiently. The crypto realm offers both risks and rewards, and informed decision-making is crucial.